In this post, I take a closer look at funding a residential solar photovoltaic system in New Hampshire. Solar power has received a lot of coverage recently because the State rebates for new solar systems have been halted due to a lack of money in the Renewable Energy Fund that is set aside for this purpose and there have also been changes in the net metering regulations. The key point I want to make in this post is that there are still a lot of good reasons to install solar in NH - the net metering changes and the lack of a state rebate should not deter you.

Among the many good reasons to install solar on your home in NH are the following:

- Electricity prices in NH are high and the production of your own solar power will provide you with some protection from further increases;

- There is a generous federal investment tax credit on the installed cost of your solar system;

- You have the ability to earn money through the sale of renewable energy credits (RECS);

- Net metering of electricity in NH means that you get credit for the excess solar generated electricity that you feed into the grid during the daylight hours and you only pay for the net amount of electricity that you draw from the grid;

- NH state rebates on the costs of installed solar might become available again in the near future.

In this post, I look at a typical system and figure out how these incentives come into play so that your solar system will eventually pay for itself over time. For my calculations and the rest of this discussion, I have assumed that a homeowner installs a 5 kW solar system (about 17 panels) at an installed cost of $15,000, which would produce 6500 kWh per year, and that the homeowner uses about 600 kWh/month (7200 kWh/year) of electricity at a rate of $0.16/kWh. I have also assumed that the homeowner lives in an area where there is a property tax exemption for installed solar. (See the NH Office of Energy and Planning website for a list of NH towns with property tax exemptions for solar installations.)

One of the most important incentives for residential solar systems is the federal investment solar tax credit. This program provides you with a tax credit of 30% of the installed cost of your solar system. This program is in effect until 2019, but the tax credit begins to decrease in 2020 and, beyond 2021, the program has not been renewed and it is possible that it will no longer be available in the future.

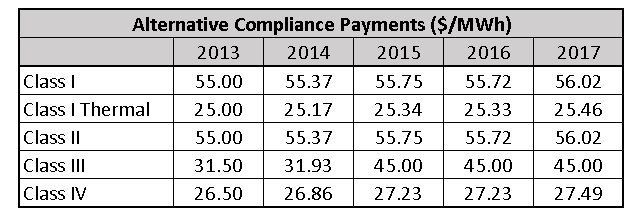

Another good incentive is the rebate provided by the NH Public Utility Commission (PUC). Until recently, a homeowner could receive up to $2500 from the Renewable Energy Fund administered by the PUC.. However, this program is presently on hold as has been reported in the press. The program has been a popular one and, owing to the flood of applications, the PUC has had to cease approving projects and awarding rebates until they know how much money they have to work with. The funds for this program come from Alternative Compliance Payments paid by the utilities. As noted in a previous post, these vary from year to year and the funding available from this source is unpredictable. I expect that the PUC will go back to funding projects, but not all installations will be able to get rebates and I expect the rebate amounts to be smaller. For the purposes of my analysis in this post, I have assumed that the rebate is not available. If you are fortunate enough to be awarded a state rebate in the future, this will just improve the cash flow and payback on your solar investment.

Another incentive is the sale of RECs, which I discussed in a previous post. Solar has a special carve-out class – Class II – in the NH Renewable Portfolio Standard: for every 1 MWh (1000 kWh) of electricity you produce from your solar system, you can sell the equivalent REC. Class II solar RECs are presently selling for between $15 and $20, so, if your 5 kW solar system produces 6500 kWh/year, you could sell your six RECs for $15 each to earn an additional $90. However, it is important to keep in mind that, as a small producer of RECs, the administrative and commission costs involved in tracking, verifying and selling those RECs could be of the order of $50, eating up a good amount of your REC income. To benefit to a greater degree from REC sales, homeowners would need higher RECs prices or should install a larger solar system to produce more RECs to defray the administration costs.

Net metering is an important incentive but as of June 2017, new regulations were issued by the NH PUC, which reduced some of the monetary benefits of net metering. With the new regulations, homeowners, whose exports of power exceed their consumption, will receive a reduced rate for their monthly net exports. I discussed this in detail in my last post and determined the rate reduction would be of the order of 20%. Homeowners with monthly net imports will continue to pay the retail rates for their net imports but the non-bypassable charges are treated separately. These charges, which include the system benefits charge, stranded cost recovery charge, and the state electricity consumption tax, are of the order of 0.5 cent/kWh and will be billed for every imported kWh no matter how much electricity is exported. The homeowner will not receive any credit for these charges for their exported kWhs.

To get a better appreciation of net metering at work, consider the following chart which shows the projected usage and solar generation for that typical NH home with a 5 kW solar system. The chart was prepared using generation data from the PVWatt calculator and residential load profiles for a NH residence from the Department of Energy. The graph shows monthly usage and generation and is different from my graph in my previous post which charted hourly data. The monthly view is important one as net metering is presently carried out on a monthly basis. The data shows that in the winter months, October to March, electricity demand is greater than solar power generation so there will be a net import of electricity into the home in those months. Homeowners would pay retail prices for those net monthly electricity imports. For the summer months, April through September, the amount of solar generation is greater than usage so there will be a net export of electricity and the homeowner would earn the lower export rates for their net exports during those months. My calculations indicate that, for the NH home we are considering in this post, a 5 kW solar system would save a homeowner $990 in electricity charges over the year. This is about $57 or 5% lower than the savings that would have been expected from net metering before the recent set of changes to the net metering regulations.

With these incentives in mind, let’s look at funding a solar system. There are three basic ways that homeowners can finance their solar systems:

- The first, and very popular with frugal northern New England Yankee types, is simply to buy the system outright using savings. The system then pays for itself through electricity savings, the federal solar tax credit, REC sales, and, if available, the NH rebate.

- The second is taking out a loan from a bank to fund the solar system and paying it back over a number of years. For the purposes of my calculations, I have assumed a $15,000 home equity line of credit (HELOC) with an interest rate of 6%, no down payment, payable over 15 years, and that the interest payments on the loan are tax deductible.

- The third approach is having a solar company pay to install the panels on your roof and you sign an agreement, known as a power purchase agreement (PPA), to purchase electricity at a reduced rate for an agreed number of years (typically 15). In a variant of this approach, known as a solar lease, you can end up owning the system after a number of years. The advantage of this approach is that there are no upfront costs, no bank loan, and you benefit during the period of the agreement from reduced electricity rates. However, in this approach, the solar company makes the investment and benefits from the incentives.

Each of these approaches have their respective pros and cons and will work for you in different ways – what is right for you depends on your savings and financial situation and how long you plan to be in your home. I took a look at each option and calculated the annual cash flows over 15 and 20 years to compare how much money each of these options would put into your pocket. My key assumptions are that the electricity price is currently 16 cents/kWh and will increase by 2%/year, that RECs are $15 each and prices will decrease by 5%/year and that the administrative costs involved in selling RECs are $50/year. The results for all three financing options are plotted below.

The outright purchase option is plotted in blue. The initial outlay of $15,000 for the system is offset in the first year by the federal solar tax credit, the electricity savings of $990/year and REC sales of $90 (offset by the associated administrative costs and commissions). Every year thereafter, the initial capital outlay is offset by the annual electricity savings and REC sales. Early in the ninth year, the cumulative cash flows go from negative to positive. This is the payback point, so the payback period would be just over 9 years. After this, the investment is cash flow-positive and, by Year 15, the cumulative cash flow from the project is almost $7000. By Year 20, it will have risen to almost $14,000. Another way to view this financing option is that it is equivalent to making a $15,000 investment and earning a 8.7% return over 20 years, a return which, for most of us, is very hard to find these days. (Should the NH rebate become available, the project cash flows would be larger, the payback period would improve to 7 years, and the 20-year investment return would increase to 11.7%.)

Should you not have $15,000 available for a solar investment, you could consider taking out a loan for the solar system. There are a number of solar-system-specific deals available from NH lenders but, for this post, I have assumed a simple 6% home equity loan paid back over 15 years with tax-deductible interest. The cash flows are shown in orange in the chart above. The attraction of this option is that there is no initial cash outlay on your part and you benefit right away in the first year from that $4500 federal tax credit, which immediately puts that nice stack of money in your pocket. Going forward, you then have annual benefits of electricity savings and REC sales, but you also have loan payments of approximately $1520 per year. In this scenario, your annual loan payments are higher than your annual savings and that, over time, eats into that Year 1 tax benefit. By Year 15 your loan has been paid off and, from that point on, you benefit fully from your electricity savings and REC sales. By Year 20, the cumulative cash flow from the project will have risen to ~$8100.

The third option, popular with many homeowners in other states, is to have a solar company install a system on your home and then sign an agreement with them to purchase the produced solar power at a rate lower than the prevailing utility rate. For this case, I have simply assumed no outlay on the part of the homeowner and they get to purchase solar generated electricity for 13 cents/kWh, instead of 16 cents/kWh, giving an annual saving of ~$200. The cash flows for this option are shown in green - the cumulative cash flow from the solar project by Year 15 is approximately $3400; by Year 20, it will have risen to $4700.

Should you have different numbers and want to consider different system sizes, interest rates, or loan periods, feel free to use the Excel-based calculator that I have posted on this site and see what works for you. Please use the calculator as a guide only. Collect as much information as you can from other sources, get multiple quotes for your solar system and quiz each solar company on their payback calculations. Ultimately the more informed you are, the better your decision is likely to be. If you have questions or comments about the calculator, please reach out to me via email.

I have summarized the 15- and 20-year cash flow information for the three options in the table below. If we look at the cash flows for the project, it is clear that the best option, assuming that a homeowner has the funds, is the outright purchase of the system. The loan option, especially after 20 years when the loan has paid off, starts looking good as well. The least favorable option, over the 20-year view, is the PPA; however, if you don’t have the funds, and don’t want to take out a loan, it might be an interesting possibility.

Many of us don’t like home-investment projects with long payback periods or lengthy loans unless we are committed to staying in our homes for an extended amount of time. A report from the Lawrence Berkeley National Laboratory indicated that solar panels do increase the value of your home, but this only applied to homes with an owned solar system and not to homes where a solar company owned the system. So, if you pay to install a solar system and sell it before reaping all the long-term energy savings, you should gain from a higher sale price.

Take a look at the solar calculator I have developed and, if you have not done so already, seriously consider installing a solar system on your home. It will put money in your pocket over the long term, it will partially shield you from future electricity rate increases, and, most importantly, you will be helping to reduce greenhouse gas emissions from the burning of fossil fuels. In the meantime, while you are contemplating installing a solar system, remember to turn off the lights when you leave the room.

Mike Mooiman

Franklin Pierce University

mooimanm@franklinpierce.edu