After a year away on my sabbatical in Botswana where I spent

my time researching off-grid solar systems and learning about energy challenges

in Southern Africa, I have returned home and am back to teaching and doing

research at Franklin Pierce University. My time in Botswana was interesting,

complicated, frustrating, and ultimately very rewarding. I had the opportunity

to meet some very interesting people, I visited solar installations in some very

unique and remote places, and was involved in the installation of a 20 kW photovoltaic

system in a village just outside of Gaborone, the capital of the country.

During my time in Botswana, I developed a far more nuanced understanding of the

challenges associated with energy supply and demand in the developing world and

learned to appreciate the reliable and inexpensive electricity and water supplies

we have here in the US.

Even though I plan to continue my interest in Southern

African energy matters, I am now focusing again on NH energy issues. I thought

it would be fitting to start where I left off a year ago and take a look at

electricity prices and what the future might hold, especially after the mild weather

experienced in New England last winter.

When looking at electricity prices, I always start by

looking at wholesale prices. We have a very dynamic market for electricity in

New England because we have a formal and well-run market organized by the

independent system operator in New England, ISO-NE. (See my blog Extraordinary

Machine to learn more.) We have 350 generators of electricity

bidding to sell their electricity into the market. This includes nuclear power

plants, coal, natural gas- and biomass-fired operations, as well as wind, solar,

and hydro. This all makes for an interesting and dynamic market.

The figure below shows historical wholesale prices for

electricity going back to 2010. It is interesting to note that, after three

winters of spiking electricity prices, prices were very calm this past winter.

This resulted from several factors.

Source: EIA

First and most important, it was a mild winter – some have

called it the winter that wasn’t (while I was away in Africa, my snow blower

only received one workout). A good indication of how mild the winter was comes

from examining the heating degree days (HDDs) (see A

Hundred and Ten in the Shade for an explanation of heating degree days).

The chart below shows HDDs for the past 12 years. We normally experience about

7000 HDD over a year (July to June) in NH and 6000 for the whole of NE; this

past year, the values were ~15% lower, with values of 6000 and 5300,

respectively. That was indeed a whole lot warmer, but I was taken by surprise

that the HDD values for 2012/13 indicated an even warmer winter that year. Like

many other folks, I tend have a short memory about past winters, except when they

are extreme, but the data show that the winter of 2012/13 was the warmest in

the past 12 years – at least as measured by HDDs values. An examination of the

wholesale prices for that winter in the figure above shows some daily prices

spikes, but nothing to the degree we experienced in the following three

winters.

Source: ISO-NE

The other key driver for low

electricity prices is low natural gas prices. Over the past winter, ~55% of the

electricity produced in New England was from natural gas: as a result, natural

gas prices had a big impact on what we paid for electricity. The two big uses

of natural gas in NE are for home heating and electricity production. With the

mild winter, there was enough natural gas to go around for both heating and

generation. Daily prices did not spike, which was quite different from previous

years. The figure below shows the extraordinarily tight correlation between natural

gas prices and electricity prices in NE – when natural gas prices spike so do

electricity prices.

Source: ISO-NE

Wholesale prices for electricity are presently of the order

of 2 c/kWh. This is great, but what are the implications for us as retail

electricity customers? Well, less positive than we would like. In NH this past

winter, retail electricity prices were in the region of 18c/kWh, almost 9 times

the wholesale rate, as shown in the figure below.

It is important to appreciate that wholesale electricity prices are a small component of what we, as rate payers, shell out for electricity. Baked into the retail rates are a host of charges: there are charges to pay for the transmission and distribution networks; there are long-term contracts that the utilities have entered to purchase electricity (most likely at higher than 2 c/kWh); there are overheads, salaries for the utility company employees, etc.; and, in the case of Eversource, there is the cost of operating their generating facilities – which produce electricity for a whole lot more than 2 c/kWh. On top of this is the profit that the regulated utilities are allowed to earn on their investment in infrastructure. It is a long list of costs and additional charges that gets us all the way from 2 to 18 c/kWh and well worth a closer look in a future blog. It turns out that the utilities from which we buy our electricity end up buying a relatively small portion of their electricity from the wholesale market – a lot of their supply is from long-term contracts that they signed up for years ago. Of course, when wholesale prices are low we don’t like this but, when prices spike up to 45 c/kWh, as they did in the winter of 2013/14, we are quite grateful that our electricity suppliers have locked into lower cost long-term contracts.

Despite last year’s mild winter weather, if this upcoming

winter were to be a very cold one, we should expect to see spikes in both natural

gas prices and wholesale electricity rates that will impact what we pay for

electricity. ISO-NE has taken some important steps in New England to mitigate these

spikes through their winter reliability program and by increasing storage of

liquefied natural gas, but we have not taken any steps to significantly

increase natural gas supply. If we have a very cold winter again, we will see

price spikes and then we will go through another round of handwringing and

planning for increasing natural gas supply. The truth of the matter is that we

do not have a long-term view about our energy supply here in New England. Plans

to increase natural gas supply have been scuttled due to opposition or our

desire to have the pipeline companies take all the risk. These are both good

reasons for not increasing supply, but we must bear in mind that most existing energy

infrastructure in the US has been built with some government intervention via

regulated monopolies. Ultimately, every one of those infrastructure investments

impacted somebody somewhere. If we do not want to invest in energy efficiency, we

as energy consumers will end up paying in one of two ways: we will pay for infrastructure

investments through costs and direct impacts on our property, our environment,

and way of life, or we will suffer the consequences of not investing in infrastructure

and creating unreliable supply conditions. Ultimately, it is our choice.

I like to take a look at what the futures markets are

predicting for NE electricity prices and, even though futures markets are about

looking forward, I also like to look back

at their prices from the previous year and see how things have changed,

especially with the warm winter we had. The figure below is a comparison of the

future prices from last year with those at present. It is clear that there has

been some change in the market’s view of upcoming electricity prices. As usual,

we are seeing a market forecast of winter price spikes, but, compared with last

year, the spikes are smaller and the base-line prices are also lower. This

chart also gives one a sense of the challenges the utility companies face as

they look to lock in sufficient electricity to supply us over the coming years.

Do they secure long-term higher-priced electricity contracts, do they subject us

to the whims of the short-term markets and maybe prices won’t spike again like

last winter, or do they mitigate potential price spikes by buying insurance

through futures contracts. These are important and challenging decisions that the

utilities make under regulatory supervision because ultimately it is NH

ratepayers that end up paying for whatever choice they make. What would you do?

Source: CME

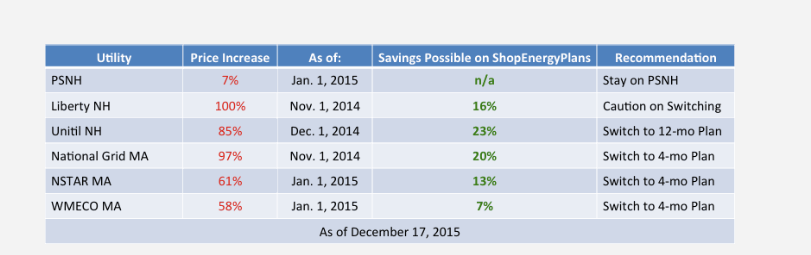

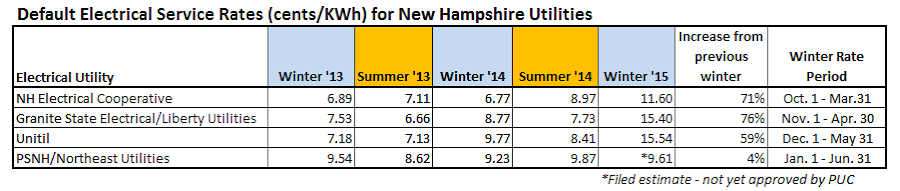

As we consider the consequences of choices, I am going to

wrap up this data-heavy post with an updated chart for default electricity

rates for the four NH regulated electricity utilities. (Remember that default

rates only reflect the retail costs of electricity and do not include the

distribution costs.) These rates, shown below, are a direct reflection of the

choices the utilities have made, under regulatory mandates, regarding the

sourcing of electricity. Presently, PSNH default rates are substantially higher

than those of Liberty, Unitil, and the NH Electric Cooperative. The rates for

PSNH presently reflect the high costs associated with operating their own

generation facilities, including the coal-fired Merrimack power plant. Even

though there have been times that the rates for the other utilities have been

higher than those for PSNH (due to wholesale market price spikes), their

default rates have generally been lower. Now that the divestiture of the PSNH

generating assets has finally started, it will be interesting to follow how

PSNH’s rates in the future will compare with those of the other NH utilities.

Source: NH PUC

That wraps it up for this post. It is good to be back

teaching in NH and learning about statewide energy matters. Feel free to email me

to suggest topics for future blogs and, in the meantime, remember to turn off

the lights when you leave the room.

Mike Mooiman

Franklin Pierce University

mooimanm@franklinpierce.edu

*Back

Home A great upbeat singalong tune by Andy Grammar.