If you are a NH resident buying your electricity from Unitil,

NH Electric Cooperative, or Liberty Utilities, you are most likely reeling from

the recent increases in winter electricity rates. This post begins a series

that takes a look at what makes up NH retail electricity prices and the reasons

behind the large increases that we are seeing for certain utilities.

Historically, electricity prices have been on the rise. The

chart below shows the 24-year historical average NH residential electricity

prices. In 1990, prices were about 10

cents per kilowatt hour (c/kWh) and then climbed to about 14 c/KWh in 1998.

Prices then experienced a slow decrease until about 2002, after which they

continued their increase to this past winter when we saw average prices of ~17

c/kWh. The trend from 1990 to 2103 represents a compounded average increase of

2.5% per year, which is the same as US inflation over the same period.

Source: EIA

The next chart looks at residential electricity prices for a

shorter time period, and compares the NH prices (in green) to those of the NE

states (brown) and to the average US monthly figure (blue) since 2000.

Source: EIA

NH has generally followed the NE average, but from 2006 to

2010 was quite a bit lower. However, over this period, our electricity rates have

been about 40% higher than the national average.

State-by-state comparison is always useful and interesting.

The figure below shows recent state rankings based on July 2014 retail

electricity prices. The NE states are all in the top 11, with Vermont and

Connecticut higher having higher prices than NH. Our electricity prices are the

7th highest in the US at 17.23 c/KWh − we can take some solace that the

price in Hawaii is more than double the NH average. On the other hand, Washington

state, which benefits from cheap hydroelectricity, has the lowest prices –

almost half of NH’s at 8.96 c/KWh.

Source: EIA

All of the electricity prices I have presented so far are average

prices and include all the charges you see on your electrical utility bill. Looking

at an electricity bill is not unlike deciphering your cell bill. There are a

lot of bits and pieces and it takes effort to understand them. There are three basic

components. The first is the cost of power, which is usually a single line item

for the cost of electricity per KWh. The second is the cost of getting the

electricity to your home, i.e., the

cost of distribution and servicing your account, which usually involves several

line items, such a fixed account charge, a distribution charge, and perhaps

even a transmission fee. Finally, there are all the odds and ends, such as

taxes, charges for government-mandated programs, etc.

The reason for all these separate charges is, as I have

noted previously in What’s It

All About, Alfie?, is that there are three key parts to the electricity

business: the generation of

electricity, typically at a large power plant located in a central location;

the transmission of electricity over long distances from the generation point

to towns and cities; and the distribution of electricity through the community

via the sub-stations, wires, and transformers to individual homes and businesses.

Not all electrical utilities focus on all aspects of the business. Some, for

example, such as my local electrical company, just distribute electricity.

Others, such as the merchant wood-fired power plants or wind farms, just focus

on generation, whereas utilities like PSNH are fully integrated organizations

involved in all three aspects of the business.

The biggest line item in your electrical utility bill is the

cost of electricity. This is the focus for the rest of this post.

The electricity industry has been partially deregulated in

NH and retail customers can purchase their electricity from different competitive

suppliers. However, this electricity still has to run through the transmission

lines and electrical wires of their local electrical utility and so customers are

charged for the use of that distribution infrastructure. Should a NH resident decide not to purchase

electricity from a competitive supplier, the local electrical utility has the

responsibility to source and supply the electricity to the customer. The

utilities do so and apply their default electrical

service rate. Although there has been competition on the residential supply

side of electricity for a few years now, the majority of NH residential

customers still rely on their local electrical utility company to source and

supply their electricity. This is the reason that increases in default

electrical service rates are so important.

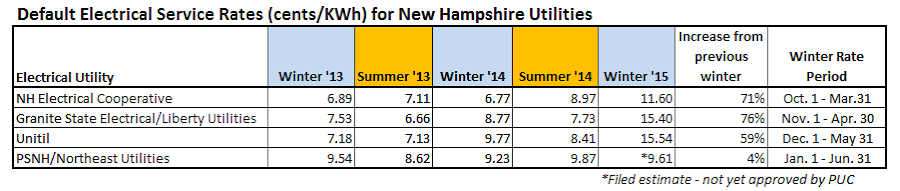

There has been a good amount of reporting lately about the

big increases in electrical service rates proposed by the utility companies and

approved by the NH PUC. The table below

summarizes the present default electrical service rates as well as some

information for previous years.

It is important to remember that these increases all relate

to electricity supply (and not to transmission

or distribution charges) so let’s take a closer look at the supply side of the

NH utilities. The rest of this post focuses on the three utilities, NH Electric Co-op, Unitil, and Liberty Utilities, with approved increases. PSNH's default rates - which are not yet approved by the Public Utilities Commission - will be the topic for my next post.

Expanding the supply aspect of the simple generation-transmission-distribution

diagram presented above, the picture quickly becomes complicated because, as

part of deregulation and the drive for competitive supply, we have introduced various

intermediaries and market participants.

The electricity supply to residences by three of the four NH

utilities (NH Electric Co-op, Unitil, and Liberty Utilities) is shown in the figure below. Competitive suppliers, shown in yellow,

purchase electricity directly from generators (red) or through wholesale

electrical markets (green). The second source of supply is from the utility

itself, shown in blue, which needs to procure electricity for its default

electrical service customers. The utility can purchase this electricity

directly from generators but the bulk of the purchases are through wholesale

electrical markets. There are two types of wholesale electrical markets – the

forward sales and the spot markets. Generators sell electricity into both of

these markets.

In order to supply electricity to their default customers,

the utilities have to forecast how much electricity will be required for a six-month

period and then lock in the price of the forecasted amount of electricity in advance. This is carried out in the forward sales segment of the wholesale

electrical markets. Although there is a cost associated with forward purchase

commitments, they offer the advantage of locking in the rate of electricity

purchases for the period. Should more electricity than forecasted be required,

the utility has to purchase this extra electricity on the spot market.

Three NH utilities (NH Electric Co-op, Unitil, and Liberty

Utilities) have just gone through the round of forecasting for this winter electricity

supply. The utilities have estimated the number of default service customers and

their total electricity consumption, and have gone out to markets and solicited

bids for supplying this forecasted electricity through the winter months. The

bids for Unitil and Liberty were reviewed, documented, and submitted as part of

their default electrical service rate application to the NH Public Utilities

Commission (PUC). The costs associated with these forward purchases of

electricity are then included, without any mark-up by the utility, in the

calculation of a single rate for winter months. The NHEC Co-op (NHEC) is unregulated

and is not required to submit its rate adjustment calculation to the PUC.

The problem for default electricity customers is that the

future prices for electricity for the next six months are high, as shown in the

chart below. As the utilities lock in their supply and prices for the winter

months, they are buying right into the winter price spikes.

The difficulty with this approach is that the utilities are

trying to forecast in September what their electricity sales in the winter will

be. This is an enormous challenge because they have to forecast how cold the

winter will be, how many customers they might have and their consumptions. They

must then commit to purchasing that electricity in advance. However, if the

winter is mild, the spot price could be lower. Of course, the opposite could

happen: it could be a brutal winter, natural gas consumption could be sky high,

and electricity prices could skyrocket like last winter. This is the challenge that the utilities and

their regulators face. Is it better to lock in the price now – called “hedging”

– or subject your customers to the gyrations of the spot markets where prices could

be higher or lower than the forward market, or should some balance be struck

between committing to a 100% hedge or a partial hedge? This is exactly the same

decision we face at home. Do we commit to a fixed price for oil or natural gas

over the winter months, or do we take our chances and hope it will be a warm

winter and that oil and natural gas will be cheaper than that fixed-price

contract. What would you do?

The regulators currently require Unitil and Liberty to hedge

100% of their six-month forecasted amounts and commit to the high winter prices.

This has lead to the higher winter default service rates posted by these

utilities.

This brings us to the question of why future prices for

electricity are so high in winter. In

two words: natural gas. As we have closed down nuclear and coal-fired power

plants in NE, we

are now generating 46% of our electricity using natural gas. Depending on

your viewpoint, that could be a good thing: it is a domestic fuel, cheap, and less

polluting than coal. It does, however, make us very dependent on the natural

gas market and fluctuations in natural gas prices. Natural gas is also used for

heating and cooking and, in winter, we do not have the pipeline infrastructure

to bring in enough natural gas for heating and electricity generation. During

winter, the natural gas utilities and electricity generators suck very hard on the

end of the natural gas straw and when demand increases, markets do what they

are wont to do and prices increase accordingly. When natural gas prices

increase, so do the prices of electricity. NE has experienced price spikes for

both natural gas and electricity during the past two winters, as shown in the

chart below.

Source: ISO-NE

Sam Evans-Brown, in a recent NHPR report, does a great job of summarizing the natural gas situation in New England. The political cartoon by Bob Englehart of the Hartford Courant points to the irony of

situation: there is an enormous amount of natural gas available in the US, but NE

is at the end of the pipeline and that causes problems for us in the high-use

winter months.

Bob Englehart

Hartford Courant

Dec 19, 2013

The future electricity prices are joined at the hip to the future

natural gas prices. In the figure below, the leftmost chart shows the future

prices of electricity and natural gas for the next three years, as provided by

the forward markets. (The forward price of natural gas is calculated for the

Boston Algonquin Citygate, which is a good proxy for NE natural gas pricing.

See The

Price for a discussion of natural gas citygate prices.) The winter spikes

in forward electricity prices match the winter spikes in forward natural gas

prices. Should you need convincing, the right-hand figure shows a direct and

very strong correlation between future electricity future natural gas prices. In fact, the

correlation coefficient is 0.966, which indicates a super-strong correlation.

(Correlation coefficients vary between 0 and 1. A coefficient of 1 indicates a

perfect correlation, whereas a value of zero indicates no correlation.) Although

correlation does not necessarily mean causation, in this case we can indeed be

comfortable in concluding that high

future natural gas prices lead to high future prices for electricity.

Returning now to the table that shows the default service

rates for the four utilities, we note that Unitil, Liberty, and NHEC reflect

increases of 59%, 76%, and 71%, respectively, over last winter’s rates. Although

NHEC also shows a large increase, their winter rates are substantially lower.

Based on what I have been able to learn, these lower rates are due to diversification

in the way NHEC purchases its electricity. NHEC does not hedge 100% of its

forecasted needs just six months ahead. Instead, it commits to forward

purchases many years out and to some just a few months out. It also purchases

electricity directly from generators through long-term (20-year) power purchase

agreements and will also purchase some of its power on the spot market where it

is able to take advantage of lower spot prices at times. As an unregulated

utility, NHEC clearly has more discretion than the regulated organizations and

some might suggest that these direct comparisons are unfair. I disagree, because

comparisons of these different approaches are important in trying to figure out

what works best for NH ratepayers.

The Co-op model has a lot of attractive features. The

customers are the shareholders and they are not incentivized by returns on

capital or dividends. They want reliable supply and the lowest possible prices

for electricity and the whole organization is focused to deliver this. With the

other utilities, I don’t see the same incentives to keep down electricity

prices. The regulated utilities, Unitil, Liberty, and PSNH, are required to

pass on the costs of electricity to their customers without any mark-up so

there is little motivation for them to search out alternatives to minimize

energy prices.

NHEC has a long-term view of electricity prices and, to my

mind, the “next six months” approach at Unitil, Liberty and PSNH, as required

by regulation, is far too short-term. Wholesale reliance on short-term forward

markets does not seem to be the best approach. There is certainly merit to the diversification

and flexibility of supply model used by NHEC and I wonder whether consideration

should not be given to incentivizing the regulated utilities to develop a

longer-term view of electricity supply. One way to do this may be to allow the

utilities the flexibility to diversify their electricity supply and reduce the

price of electricity below that of the short-term forward markets and to share

significantly in any resultant savings.

While researching this post, it struck me that there is considerable

variety in the types of electrical utility and a great deal of experimentation

occurring in NH. NH arrived early to the deregulation ball and then pulled back

when things went awry in California (see Should

l I Stay or Should I Go?). As a result we have an integrated utility, PSNH,

still in the generation, transmission, and distribution business; we have two

deregulated utilities, Unitil and Liberty, that are out of the generation

business and who buy all their electricity on the wholesale markets; we have a

cooperative in NHEC which is not regulated by the NH PUC; and we have a few

municipal electric companies. With all of these options in NH, we have a unique

opportunity to figure out which model is the best, and which consistently and

reliably delivers low cost electricity to NH ratepayers.

The past two winters have seen a refrain of “Gonna Take You

Higher”* and I anticipate that the NH annual average electricity price will

rise again this year. When deregulation was introduced, we expected the markets

to automatically deliver lower electricity costs. This has not always happened.

Sure, we have run into cold winters, natural gas pipeline capacity issues, and

the shutdown of nuclear and coal plants, but deregulation appears to have

fallen short on some of its promises. This requires some reflection and is

certainly worthy of a future blog post.

Electricity markets are different from other energy markets,

many of which have an inventory buffers in the form of storage or stockpiles to

overcome temporary interruptions and market dislocations. Electricity, on the

other hand, needs to be simultaneously generated and consumed: it cannot be

stored, and the underlying market components and structures are hellishly

complicated. There are a limited number of market players, liquidity can be problematic

at times, and − regardless of the cost − it needs to be “on” all of time.

Moreover, in NE, the market for electricity now rests on top of the local

market for natural gas – another commodity for which local storage is very

limited and where delivery constraints come into play. With so much of our

electricity dependent on natural gas, we could even reach situations where

there is insufficient natural gas to generate the electricity we need. From

this viewpoint, it appears that heavy dependence on natural gas has compromised

the reliability of our electricity supply. This is all frightfully messy.

I am a proponent of the letting the invisible hand of the

market do its work, but it does need to do so under the very visible and

intelligent hand of regulation. My 1/8 of a KWh worth is that progress has been

made but there is still work to do to get things right for NH electricity rate

payers.

Until next time, remember to turn off the lights when you leave the room.

Mike

Mooiman

Franklin

Pierce University

mooimanm@franklinpierce.edu

(*Gonna Take You Higher – A line from the chorus of Sly and

the Family Stone’s tune, Want to Take You Higher, and a great

example of the funky soul music from the 1960s. This was one of the tunes in

the Family Stone’s set at Woodstock when they played it at 3 am and had the crowd chanting “Higher”. Here is a video of a

1969 show that gives you a sense of the power and drive of Sly and the Family

Stone. Enjoy I Want to

Take You Higher.)

No comments:

Post a Comment

Please feel free to comment but note that I have added a verification step to avoid the large amount of spam that can make its way into the comment area. An annoying but necessary step these days.