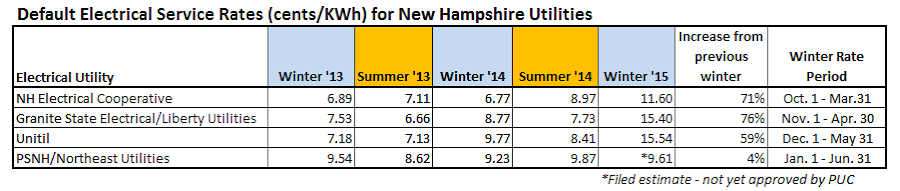

In my last post, I presented the table below and made a big

deal about the large winter price increases that have been put forward by NH

Electrical Co-op, Liberty and Unitil, but did not discuss the surprisingly small

increase put forward by PSNH (highlighted in yellow). However, in an earlier

post, River’s Gonna

Rise, I made the statement that, “…with electricity prices shooting

up this winter and with PSNH customers, for the time being at least, somewhat

shielded from these increases, this does give one pause for thought and to

consider that ownership of generating operations may perhaps have some

benefits.” Well, I have been thinking long and hard about this and about PSNH’s

relatively low winter rates and, after some research, analysis, charts, and

graphs, I have now come to a rather different conclusion. Read on.

For the three-winter period shown in the table above, I have

plotted the default electricity rates for the different utilities in the graph

below. Bear in mind that these data are not

exactly comparable because they involves slightly different time periods (e.g., the NH Electric Coop (NHEC) winter

rate runs from October to March, whereas that for PSNH runs from January to

June), but it is a convenient way to view the data. Over this three-year period,

PSNH rates were generally higher than those of the other utilities except for

this upcoming winter, however the other utilities tend to show larger fluctuations

from season to season, which PSNH does not.

Because the other utilities no longer have generating

operations, they purchase electricity from the wholesale markets or (in the

case of NHEC) directly from generators, as shown in the figure below (excerpted

from my last post).

As a result, the other utilities are more subject to the ups and downs of the

wholesale electricity markets.

However, PSNH is still an integrated utility – it owns its

own generating assets – and, as a result, generates a lot of its own

electricity. The electricity supply picture for PSNH is therefore somewhat

different, as shown in the following figure, where PSNH has a large supply of electricity

generated from its own operations (shown in grey).

I have written about PSNH’s generating operation in several posts,

including a recent overview of their hydro assets in River’s Gonna

Rise and the possible sale of their generating assets in Options.

PSNH has approximately 1200 MW of generating assets, as shown below.

The problem for PSNH is that their main assets are the old

coal-fired Merrimack and Schiller plants and the relatively inefficient dual-fuel

plant in Newington. In a market with low natural gas prices and very efficient

dual-cycle natural gas plants, these older PSNH plants are generally non-competitive

and there is often little call for the expensive power they generate.

To understand just how much electricity PSNH produces from

its own operations, I took a close look at the data presented in PSNH’s latest

filing for winter electricity rates. The filing included electricity

supply numbers for the whole of 2014, which were a combination of actual year-to-date

and forecast numbers. I used this data

to prepare the Sankey diagram below. (For more on Sankey diagrams, see Another View

of Statewide Energy Flows in New Hampshire.)

The origin of PSNH’s 2014 electricity supply is shown on the

left in gigawatt hours (GWh). The total amount supplied is 4901 GWh. The flows

in grey originate from PSNH’s own generation operations, whereas green flows

are from contracted suppliers or wholesale market purchases. The right side shows

what happens to the electricity generated and sourced by PSNH: the bulk of it, 79%,

is sold directly to PSNH customers; transmission and distribution losses are

about 6%; and the remaining 15% is sold into the wholesale markets - mainly

during the cold winter months.

The chart below shows the same data on a month-by- month

basis, calculated as the percentage of PSNH’s total output generated by its own

operations. These 2014 numbers are a combination of actual (blue) and forecast

data (orange). The chart clearly shows that the PSNH operations – largely the

coal-fired Merrimack plant – really ramp up in the cold winter months and are

responsible for the majority of PSNH output during these times. In the warm summer months, when natural gas is

cheap and readily available, it is not financially prudent to run the coal-fired

operations. Instead, it is cheaper for PSNH to buy natural gas-generated electricity

from the wholesale markets. At these times, the bulk of PSNH supply comes from

contracted or wholesale market purchases. (That little blip in July comes from

supplying electricity for our summer air-conditioning needs.) The final column, in red, shows that the

amount of electricity that PSNH will generate from its own operations this year

is projected to be right around 50%.

In the Sankey diagram above, I have included the costs of

the electricity purchased by PSNH. Aggregating these costs and calculating a

weighted average, I determine that that average cost of purchased energy is 5.4

c/kWh. If this purchased energy is 50% of PSNH output and PSNH is selling

electricity at 9.5 c/kWh to its customers, it takes only simple algebra to

determine that the all-in cost associated with PSNH-generated electricity is 13.6 c/kWh (0.5 x 5.4 + 0.5 x 13.6 =

9.5). And therein lies the rub: At present utilization rates and with low

electricity prices in the summer, the PSNH generation facilities are very expensive

to run. The high costs associated with its coal-fired operations weigh heavily

on the rates paid by PSNH customers and explains why, more often than not, PSNH

rates are higher those of the other NH utilities.

I realize that this calculation represents a gross

simplification of a complex matter and it allocates the burden of all government-mandated

electricity programs, like RPS and RGGI, to the generating assets only. Even so,

the bulk of the costs originate from the assets themselves so I am comfortable

with the simplification. This straightforward calculation, when applied to 2015 projections, clearly demonstrates

that PSNH low winter rates for 2015 are not as a consequence of its own generating

assets. Instead, they are a direct

result of its portfolio of supply arrangements from wholesale market purchases

and power-purchase agreements from wood-burning plants, including the new Burgess

plant in Berlin, the wind farm in Lempster, and other generators. So my earlier statement that, “…with

electricity prices shooting up this winter and with PSNH customers, for the

time being at least, somewhat shielded from these increases, this does give one

pause for thought and to consider that ownership of generating operations may

perhaps have some benefits,” does, in retrospect, not appear to have been well

founded, at least from a electricity rate point of view.

This calculation also underscores the decision that

lawmakers and regulators in NH are wrestling with at this time: Is it in the

best interest of PSNH customers to complete the process of deregulation and

compel PSNH to sell its generating assets? If this happens, PSNH will be like the other

utilities in NH and will need to source 100% of its electricity from the

wholesale markets in New England or directly from generators through long- and

short-term contracts. The next (and, I think, the most important) question is: Can

this be done for less than 13.6 c/kWh once those generating assets are sold?

If PSNH has to source all its electricity from the wholesale

market, they could run into a problem similar to that discussed in my last

post, where, like Liberty and Unitil, PSNH could end up buying right

into those winter peaks created by natural gas shortages. In my last post I was somewhat critical

of the short-term “next six month” approach that regulations compel Liberty and

Unitil to use to source electricity for their customers. I suggested that a

portfolio of different sources, as well as long- and short-term supply, be

used. As it turns out, the regulators are ahead of me on this one: the NH Public Utilities Commission (NH PUC) recently

issued Order 25,732

to review the sourcing of electricity by Unitil and Liberty. It is very likely

that any changes in sourcing approaches would apply to PSNH after the sale of

its assets, so it will be interesting to follow developments in this area.

It is important to note that this is not the whole story. If

PSNH is mandated to sell their generating assets, they will − and correctly, I

might add − expect to be compensated for the difference between the book value

of those assets and what they will raise from their sale. All indications are

that this difference, known as stranded costs and discussed in Options,

will be substantial. These stranded

costs will come out of the pockets of PSNH customers. The NH regulators at the

NH PUC are presently trying to determine how large this amount will be.

In the equation

Stranded costs = Book value – Sale value,

there are obviously two components, both of which are being

scrutinized and debated at this time.

As I noted

previously, the generating assets are

listed on the PSNH financial statements at $ 1.1 billion but with a net

depreciated value, or book value, of $ 660 million. This $660 million value includes

the $ 422 million recently spent on the scrubber that was installed at the

Merrimack plant to reduce mercury emissions from the burning of coal. The

original budget for the scrubber was "not to

exceed" $ 250 million, but, by the

time it was completed, the price had skyrocketed to $ 422 million. A series of

hearings was recently held to determine

whether it was prudent for PSNH to have spent $ 422 million for a scrubber on

an aging coal plant, and we are currently waiting for the NH PUC to make a

determination on the prudency of this investment. I anticipate that PSNH will file

an objection to the determination and we can then expect the battle to play out

in the NH courts.

The second component of the

stranded cost equation, the sale value of PSNH generating assets, is also being

analyzed. Consultant

reports have been commissioned, blogs have

been written, and one thing is clear: in

this low-cost natural gas market, the coal-fired assets of PSNH have relatively

little value. Interestingly, the crown jewels in the PSNH generating portfolio

are their hydro assets, about which I have recently

written.

In the end − after all the

consultant reports, hearings, determinations, and court battles − I believe the

book value will be decreased and the sale value will erode, which is still

going to leave PSNH ratepayers on the hook for those stranded costs. In Walking on

the Wild Side, I indicate these stranded costs may be of the order

of 0.5 c/kWh. This has been borne out in a recent status

report issued by the NH PUC. This is an important number, but of far

less importance than the numbers that will come from answering this one very

important question: Once the PSNH assets are sold, can PSNH reliably, consistently, and

over the long term, source electricity at a lower cost than that incurred by

their generating assets? This is the

heart of the matter* and one that PSNH, ratepayers, legislators, regulators,

and courts in NH will be struggling with over the next few years.

This post has covered a lot of ground, so, to wrap it up, let

me leave you with the following takeaways:

- PSNH rates are low this

winter but this is not a consequence of owning their generating assets. Instead,

it is a result of their low cost purchases through a portfolio of long-term

power purchase agreements and wholesale market purchases.

- The PSNH generating assets

have value in cold winter months when natural gas is expensive. As natural

gas supply to the region improves over the next few year, this will become

less of an issue and the value of coal-fired operations will diminish even

further.

- Scrubber prudency reviews

are an important step in moving PSNH to divest its generating assets but,

in the big picture, I do not anticipate that this will have a significant

effect on the electricity rates that PSNH rate payers will end up paying.

- More important will be the

rates at which PSNH can procure all its

electricity from the wholesale markets and whether they

will be able to adopt a portfolio approach to sourcing this electricity.

Until next time, remember to turn off the lights when you

leave the room.

Mike

Mooiman

Franklin

Pierce University

mooimanm@franklinpierce.edu

(*The Heart of the Matter – The very moving song from Don

Henley’s album The End of Innocence. I

really like Henley’s version but it has been very well covered by India Arie.

Here are both - you decide which you like best.

Don Henley

or India Arie)