While we are all enjoying the fine summer weather, I

thought it would be useful to take a look back at electricity rates for this

past winter and to think about what the coming winter might hold for us. Before

we get into this topic, however, I need to note that this will be my last blog

on New Hampshire energy issues for the next year. I am heading off to Botswana,

Southern Africa, as a Fulbright scholar, where I will be studying energy

matters in Botswana, with a particular focus on the solar energy field and

storage technologies. As you can imagine, the energy issues in a developing

country are quite different. Here in NH, we are all used to reliable,

inexpensive electricity whereas, in Africa, two-thirds of the population do not

even have access to electricity, it can be very expensive, and, when available,

it is often not reliable. In NH, we sometimes seem intent on blocking the

development of any energy projects, whereas in Africa energy infrastructure development is welcomed, encouraged,

and supported. The energy field and the associated issues will be quite

different and I am looking forward to learning more. While down in Southern

Africa, I will be firing up a new blog, titled Energy in Botswana, so if you are interested in following my

energy explorations in this part of the world, drop me an email and I will put

you on a notification list. But back to NH energy matters…

- Wholesale prices (and thus retail prices) for electricity during the 2013/2014 winter increased due to natural gas pipeline constraints.

- The three deregulated utilities—NH Electric Co-op, Unitil, and Liberty Utilities— substantially increased in their winter default service rates, with price increases ranging from 60 to 75%.

- PSNH rates only increased by 4% and they ended up with the lowest rates in the state.

- The increases were due to the fact that Unitil and Liberty Utilities were compelled to lock in electricity prices from the short-term 2014/2015 futures market for electricity where prices had skyrocketed due to the high prices of the 2013/2014 wholesale market.

- I made the recommendation that the utilities should not be restricted to purchasing their future electricity supply to just six months out and that they be allowed to adopt a portfolio approach of both long- and short-term electricity supply agreements to mitigate the effects of short-term price spikes.

I thought it would be interesting to take a look at what actually

happened over the winter and what has happened since then.

As shown in the figure below, wholesale electricity prices did spike over the winter but nowhere near

the frequency, duration, or magnitude of the previous winter. Peak prices were

even lower than those of the 2012/2013 winter.

Data Source: EIA

Compared with the previous two winters, prices increases

this year were moderate and actual wholesale rates were lower than the futures

prices at the start of the season. In October 2014, futures prices for the

winter peak in January and February were ~18 c/kWh (see Gonna

Take You Higher). In

January and February 2015, although the wholesale market prices peaked at ~12 c/kWh

for January and 20 c/kWh for February, the daily averages for those months were

a lot lower—at 8.7 and 13.7 c/kWh, respectively.

This means that when the electrical utilities bought electricity on

the futures market, it is likely they overpaid relative to actual day-ahead wholesale

prices. However, this the essence of hedging (or locking in) the price of a

commodity ahead of the time you actually need it: if actual prices turn out to be lower, you end

up overpaying, but, if prices end up higher, you are very pleased. Hedging is

just like paying for insurance – you pay a premium to protect yourself: it is

not about getting the lowest possible price; rather, it is about reducing risk

and avoiding exposure to excessive price increases.

After those very large winter increases, the summer default

rates plummeted and the three deregulated utilities ended up with rates lower

than that of PSNH, which again had the highest rates in the state. The figure

below gives an historical record of the default rates for the four NH

electrical utilities.

Data Source: Courtesy of NH PUC

Futures prices for electricity for the upcoming winter are currently

pretty low compared with those of years past (see the figure below). The futures markets indicate prices of the

order of 12 c/kWh for the Jan/Feb 2016 winter peak, with further decreases expected

in the following winters. These lower futures prices are most likely a

reflection of the changes that we are seeing in the New England electricity

market. The local electricity supply coordinator, ISO-NE, has worked hard to

mitigate the extent and duration of the winter spikes by implementing a winter

reliability program in which owners of oil-based generating facilities and

liquefied natural gas storage operations are paid to store fuel. This ensures a

reliable and predicable backup supply of alternative fuels to generate

electricity should there be bottlenecks in the natural gas supply from

pipelines.

Data Source: CME

My predictions for electricity rates for the next few years

are that we will continue to see short-term winter spikes due to natural gas

pipeline congestion during high demand periods but that these spikes will

moderate over time as ISO-NE expands and improves its winter reliability

program, as some the natural gas pipeline projects get implemented, and as more

Canadian hydro power makes its way down to New England.

Since the deregulation of electricity supply in NH, customers

are no longer compelled to purchase their electricity from their default

provider. Given the big fluctuations in default energy rates and the

availability of competitive suppliers, I thought it would be interesting to

look at how customers have responded – are they flocking to competitive

suppliers or are they staying with their default utility? I took a look at the

customer migration numbers for PSNH – the largest NH utility. The chart below

shows data for the past three years. The data in orange show that, from about

July 2012, the number of residential customers purchasing their electricity

from competitive suppliers started to accelerate, and this trend really kicked

in in the first quarter of 2013 when there was big movement of customers to

competitive suppliers. The numbers reached a peak at the end of 2013, when

approximately 28% of PSNH residential electricity customers were supplied by other

companies. Since then, there has been a slow decrease and, presently, some 20%

of the electricity supply to residences comes from competitive suppliers. The

data in blue, which is for all PSNH customers (including small and large

commercial and industrial enterprises), show that, in October 2013, almost 60%

of all electricity distributed by PSNH came from competitive supplies. The

numbers have fluctuated since then but, this past winter, this number fell

below 40%, corresponding to a big migration back to PSNH due to their lower

default rates. There is now a slow movement away from PSNH again, as lower

summer rates begin to appear attractive to the commercial and industrial

enterprises.

Data Source: NH PUC

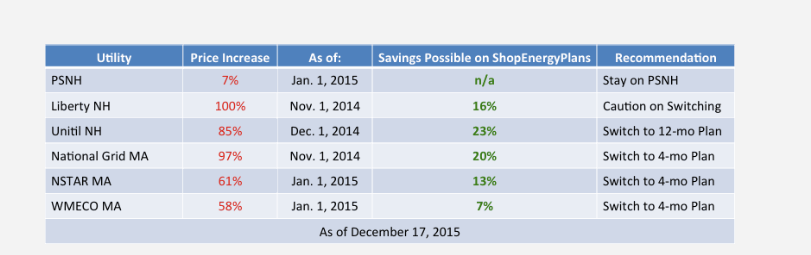

Some months ago I

wrote about a website called shopenergyplans.com, which

allows you to compare electricity costs from competitive suppliers in your

service area. At that time, shopenergyplan.com was only presenting information

for suppliers who agreed to have their rates posted. Shopenergyplans.com has

advanced since then and now provides details for a larger number of competitive

suppliers. In my last blog on this topic, I noted that rates for only three

competitive suppliers were listed for the Manchester service area. Yesterday, I

noted that are now seven different suppliers listed, with 40 different plans,

ranging from 1 to 36 months, and including various renewable energy sources. A

few weeks ago, shopenergyplans.com notified me of two electricity supply plans

from competitive suppliers offering lower rates in the PSNH service area. This

website is a good place to start if you are considering looking for a

competitive supplier but I caution you to do your research and make sure that you

understand the contract terms – remember that there can be costs for switching

and the competitive suppliers can

shunt you back to the service utility in your area at their discretion.

As I noted at the start, this will be my last blog until I

return next year.* If you are interested in following my energy adventures down in Botswana, please drop me a note at my email address below. In the meantime,

thank you for your interest in my work. Keep in touch, let me know what is

happening in NH while I am away, and remember to turn off the lights when you

leave the room.

Mike

Mooiman

Franklin

Pierce University

mooimanm@franklinpierce.edu

(*Next Year - A very appropriate song by the Foo Fighters

featuring the ubiquitous Dave Grohl. Great video too. Enjoy Next Year.)