Home heating

oil has been in the news a great deal the past few weeks in New Hampshire as

oil deliveries from one of NH’s largest oil delivery companies, Fuller Oil, have

been compromised. Many customers became concerned about late and partial

deliveries and had difficulty contacting the company by phone. The NH Attorney General

became involved and there has been a lot of discussion in the press and legislature

about getting oil to customers and how to protect customers who prepaid for oil

delivery contracts.

Oil delivery

problems were not unique to NH. Just last week, there were radio reports of

home heating crises in other states and where

Department of Transportation regulations, which limit the hours that propane

and oil delivery drivers can spend on the road, were suspended to enable oil

and propane delivery companies to get

oil to their customers. With all this recent attention on home heating oil, I

thought it would be timely to take a closer look at this topic to see what we

could learn.

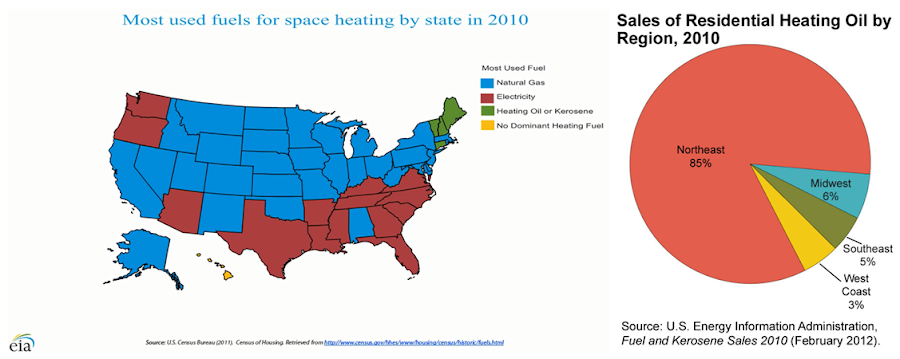

Like many

other folks in Northeast, I use oil to heat my home. In fact, as I noted in an

earlier blog, home heating oil is the predominant home heating fuel used in

most of New England. The green highlights in the map below clearly show our

dependence on oil. In fact, the Northeast, which includes New England plus the

mid-Atlantic states down to Virginia, is the largest home heating oil market in

the world. As seen in the pie chart below the Northeast is responsible for 85%

of home heating oil used in the US.

Let’s start

with the basics. Home heating oil is a hydrocarbon fuel which is produced from

the refining of crude oil. Crude oil itself is a mixture of different

hydrocarbon compounds and, in the refining process, the crude oil is heated and

various ranges of hydrocarbon molecules are separated from one another by the

process of distillation. There are

different grades of fuel oil produced during the distillation process which are

termed distillates. These distillates include jet fuel oil, gasoline, diesel,

and fuel oils of different grades running from Number 1 to Number 6 fuel oil.

As the fuel

oil number increases from 1 to 6, so does the viscosity of the oil and the

average size of the hydrocarbon molecule in the fuel. Fuel oils in the Numbers

4 to 6 range are commonly used to fire the boilers on ships and are often referred

to as bunker fuels. These bunker fuels are thick, goopy mixtures which normally

need to be preheated before use. Depending on the grade of crude oil used as a

feed material in the refineries, these bunker fuels can contain a lot of

contaminants, such as sulfur, which make them highly polluting.

The home

heating fuel that most of us use is known as Number 2 Heating Oil. Number 2 heating

oil is similar in composition to kerosene and the automotive diesel you can

purchase at the gas station. During the recent home heating oil shortage, many

folks supplemented their home heating oil with diesel and kerosene but I

recommend that you check with your oil company about the interchangeability of

these fuels. The biggest difference between #2 heating oil and the diesel fuel

used for transportation is the sulfur content. Home heating oil typically

contains a lot of sulfur, which can range from 500 to 2000 parts per million

(ppm), whereas transportation diesel has a sulfur content below 15 ppm.

Due to

federal regulations regulating tail pipe emissions from diesel engines, the

sulfur content of diesel fuels sold at gas stations is now very low in order to

limit the amount of sulfur dioxide that is produced as a pollutant from the

combustion of these fuels. Sulfur dioxide is a nasty combustion product and

contributes, along with the burning of coal, to the acid rain and regional haze

problem.

Even though low

sulfur diesel for transportation use has been in place across the US for a

while now, this is not the case with home heating oil. Here regulation is very

much on a state-by-state basis. With the encouragement of the federal

authorities, many New England states have been pushing to reduce the sulfur

content of home heating fuels. In 2005 there was a proposal by

some of the Northeast states to reduce the sulfur levels in home heating oil

to reduce regional haze problems. It was recognized that home heating oil was the

second largest contributor to sulfur dioxide emissions in the Northeast (after

coal-fired power plants). Action on this proposal has, however, been rather

patchwork in nature. Some states, such as New York, immediately moved to very

low sulfur home heating oil but other Northeast states have adopted a phased

approach, moving incrementally to heating oils with less than 500 ppm sulfur

and then to heating oils with less than 15 ppm sulfur. These very low sulfur

fuels are known as ultra low sulfur distillates or

ULSD and are almost identical to transportation diesel fuel.

The graphic

below shows the time line for home heating oil changes in the Northeast states.

New York already requires the use of ULSD and this year Vermont, Massachusetts

and New Jersey are dropping their maximum sulfur levels to 500 ppm in the first

step and will require ULSD later on in the decade. Although Connecticut is not

shown on the graphic below, they have a law in place mandating ULSD for home

heating oil if surrounding states pass similar legislation. I find it

interesting that NH is conspicuously absent from this initiative but it is my

understanding, based on conversations with the folks over in the Air Resources Division at the NH Department of Environmental Services, that this might come up

for reassessment in the near future. They are taking into account the actions

of neighboring states as well as the fact that the fuel oil industry, including

refiners and wholesalers of home heating oil, are moving over to the low sulfur

fuels anyway and regular higher sulfur fuels might be difficult to come by in

the future.

Another sign

of the change to very low sulfur fuel oils is that the Heating

Oil Reserve, a federal program to keep a strategic reserve of 1 million

barrels (42 million gallons) of home

heating oil in place, now requires storage of ULSD and not #2

Heating Oil. This reserve was created in 2000 to minimize potential disruptions

in heating oil supply in the high usage Northeast area. Half of the reserve is

located in Revere, MA, and the other in Groton, CT. Even the benchmark home

heating oil price, the heating oil futures contract on the New York Mercantile

Exchange, was changed in 2013 and is now based on the delivery of ULSD and not

regular high sulfur #2 home heating oil.

In many

respects, there is an inevitability to NH’s eventual conversion to ULSD home

heating oil and, based on the conversations I have had with folks in the

industry, everyone, from refiners to wholesalers to home heating oil retailers,

wants to change to a standard home heating oil. Because of the patchwork of home

heating oil regulations across New England, oil dealers and wholesalers presently

have to keep track of different grades of home heating oil, including ULSD,

<500 ppm sulfur fuel oil and regular high sulfur #2 home heating oil. This creates

administrative, tracking, storage, logistic and cost challenges for these

companies that they would like to eliminate.

The most

important reason for the change is that ULSD home heating fuel is simply a

cleaner burning fuel. It pollutes less, it produces less sulfur dioxide and oil

service companies regularly comment on the fact that is better for oil burning devices:

furnaces running ULSD show less deposit build up, the filters require less

frequent changes and the units generally require less maintenance.

Let’s turn now

to some New Hampshire specifics for home heating oil. Recently Dave

Brooks of the Nashua Telegraph published a great article about NH home

heating oil challenges and particularly the problems that NH’s largest oil

distributor was having in supplying its customers during the recent cold spell.

It’s well worth a read if you haven’t seen it yet.

Like the

other Northeast states, home heating oil is a big deal in NH. Data from the Energy

Information Agency (EIA), shown below, indicate that 47% of NH homes still

use oil heat.

However, when

the long-term fuel oil figures are examined, one see that home heating oil

consumption, for residential and commercial use, over the past decade has

plummeted and is now about 55% off the peak 2004 levels. See the chart below.

Consider that

there are 519,000

occupied housing units in NH (including multi-unit dwellings), 47% of which used oil heat and consumed

the 100 million gallons used in 2012, then

we can calculate that the average NH home

burned only 410 gallons of oil in 2012. Well, this calculated annual average oil

consumption left me totally gobsmacked as this is a substantially lower number

than the usual annual household oil consumption figure of 800 gallons

per year that is used by many working in the home heating field. The 800 gallons/year figure is

a number even I have been using for

years and which is in line with my own oil consumption.

This conundrum

led me to dig deeper into oil consumption numbers. In the process, I learned

that home heating oil consumption across the US has plummeted and that the EIA

actually uses a US average of 551 gallons per year for homes with oil heat. The

number for the New England states is slightly higher at 651 gallons/year. These

data are based on the 2009

Residential Energy Consumption Survey and are used to forecast national

heating oil consumption for the Annual Energy Outlook

reports. My calculated numbers for 2009, using data from the chart above (138 million gallons of oil in 2009), yielded

an average household oil consumption number of ~590 gallons/year, which is in

line with the 2009 national average but somewhat lower than the EIA’s New England value. Based

on my numbers, which use recent oil consumption data, it looks as though we

have gone from 810 gallons/year in 2003 to 580 gallons/year in 2009 to 410 gallons/year in 2012. This is a

massive decline and it begs the question: What is the reason for this big

decrease?

Others have looked at this and

have noted similar trends but have not come up with definitive answers. The

first conclusion that many people jump to is that there has been a big

conversion to cheaper natural gas - but this is not borne out by the data.

In my

subsequent investigations, I determined that the decade-long fall off in NH

home heating oil use is due to a combination of factors, including the

following:

- There has been a decrease in the number of NH homes that use oil heat. According to the American Community Survey, in the 10 years between 2002 and 2012, the number of homes with oil heat in NH decreased by 10% from 272,000 to 245,000. These conversions were most likely to fuels like wood pellets, natural gas and, in some cases, to propane.

- Over the past 10 years, there has been a warming trend and the winters have generally been warmer. In the blog post, A Hundred and Ten in the Shade, I introduced the concept of heating degree days and, in the chart below, I have plotted the annual heating degree days (HDD) for NH over the past decade. A decrease in heating degree days means less need for home heating. Since 2002, the heating degree days for the winter have decreased by about 10%. Considering that there is a direct correlation between HDD and oil consumption, this downward trend should manifest as an equivalent reduction in heating oil consumption.

- An informal survey that I conducted indicated that a good number of NH homeowners who use oil heat, have, in the past decade, also installed wood pellet stoves or propane heaters into their homes to supplement their oil heat and to reduce their consumption of expensive home heating oil. It is challenging to find good data on this trend but the popularity of wood pellet stoves has certainly increased.

- With high heating costs, driven by the increase in oil prices over the past decade, many homeowners had energy audits done on their homes, and then took measures to improve the weatherization of their homes and some even installed more efficient oil-fired furnaces. According to Dana Nute, General Manager of the Resilient Buildings Group, these energy-efficiency projects can reduce home energy use by 25 to 30%.

- Finally, also according to my informal survey, part of the reduction is due to simple old-fashioned Yankee frugality. As home heating oil prices went up, some NH homeowners simply turned down their thermostats. A colleague who keeps detailed records of his NH home heating expenses, shared data with me which I have plotted in the chart below. As you can see, by the simple expedience of turning down his thermostat, he has reduced his oil consumption from ~650 to 700 gallons/year to about 450 gallons/year. A frugal Yankee indeed!

We have certainly

covered a lot of information in this blog post. We have learned that there is a

movement underway and that our home heating oil will, over time, be converted

to a cleaner burning and less polluting ultra low sulfur diesel fuel oil. We

have also seen the dramatic decrease in home heating oil consumption in New

Hampshire.

In researching

this blog, I was also somewhat chagrined to learn that my own oil usage is

higher than the US average, and not in a good way. My only mitigating factor is

that I use home heating oil for both heat and hot water purposes. It is clear

that I should show more Yankee frugality and that I too need to turn down the setting on my programmable thermostat. In fact, I will do so right away - so hold on a minute or two ……

…..Well I’ve

returned feeling better that I have now taken some concrete action. However, it

has struck me that by the time I have completed this blog post, my thermostat

co-pilot will be down to visit me in my home office to inquire sweetly if there

is something wrong with the oil furnace. I will then explain to her about Yankee

frugality and the new temperature regime that is underway and after my

explanation, she will inquire, a lot less sweetly, if there is something wrong

with my mind. She will then suggest, and even encourage me to take myself, my

laptop and the concept of Yankee frugality down to the unheated shed at the

bottom of the garden where I should consider myself free to conduct experiments

in sub-zero living to my heart’s content. On reflection, more insulation would

seem to be the more prudent approach.

In my next

blog I will take a look at some of the pricing issues in the home heating oil

business. Until next

time, remember to turn off the lights when you leave the room and maybe even

turn down that thermostat by a degree or two.

Mike Mooiman

Franklin Pierce University

mooimanm@franklinpierce.edu

(*Crude Oil Blues – A tune

by country guitar picker and songwriter Jerry Reed with the memorable line

“We’re low on heat, we’re low on gas and I’m so cold I’m about to freeze

my…self”. This song was a minor hit in 1974. Jerry Reed is better known for

songs like Guitar Man, recorded by

Elvis, When You’re Hot, You’re Hot,

and one of my favorites, She Got the

Goldmine, (I Got the Shaft).)