As a consequence of the upturn in natural gas recovery from shale gas deposits, a great deal of propane has been produced as a byproduct, so much so that the US is now exporting significant quantities of propane. However, here in New England we don't seem to be benefitting from this surge in propane production. In this week's post, I endeavor to understand why we pay so much for propane in New Hampshire.

In my last post, Under Pressure, I presented some facts and figures about propane usage in New Hampshire. I pointed out that propane was a versatile fuel as it can be easily stored, it can be used for both heating and cooking and it is particularly useful in remote areas where there is no natural gas supply. I also presented data showing that propane usage in NH is higher than in the other New England states and that propane, on an energy output basis, is presently the most expensive fossil fuel in New Hampshire.Before we dig into propane pricing, it is useful to understand the production, processing and distribution of propane. To do so, let's follow the fate of a propane molecule that is associated with a natural gas deposit down in Texas - as that is the origin of a lot of our propane supply here in New England. The raw natural gas drawn from a natural gas well can contain between 70 and 90% methane but also, depending on the deposit, between 0 and 20% of hydrocarbon gases like ethane, propane, butanes and sometimes longer hydrocarbon chain molecules, like pentanes and hexanes. There might also be 0 to 8% carbon dioxide, as much as 5% sulfur as hydrogen sulfide, some nitrogen and water, and a host of other minor level contaminants. The first processing step is the removal of any easily condensable material, like water and long-chain hydrocarbons. This is normally done close to the natural gas well. The gas is then pumped to a natural gas processing plant where sulfur, mercury, nitrogen, and carbon dioxide are removed. Our propane molecule is all the while being batted along these various separation processes following the methane.

The gas mixture is then subjected to a low temperature cryogenic process in which all the other hydrocarbons, like our propane molecule as well as natural gasoline, a mixture of pentanes and hexanes, isobutene, butane and ethane, are condensed into liquid, hence the term natural gas liquids or NGL. The methane gas, now free of the bulk of contaminants, is fed into a natural gas pipeline for storage or distribution. The mixed natural gas liquids, now known as Y grade, along with the propane molecule we are following, are then routed through a pipeline to the fractionation plant where the mixture is slowly warmed up and separated into various component fractions. First to be recovered is the natural gasoline fraction, followed by butane and isobutene and then, finally, propane and ethane are separated. Our propane molecule, along with the rest of the propane fraction, after the pummeling in the fractionation plant, is then pumped to large underground storage caverns in Mont Belvieu, Texas, which serves as the main distribution hub for propane throughout the country. Pricing of propane at the Mont Belvieu hub also serves as the basis for commodity pricing of propane used by energy traders in the US. As I mentioned in my previous post, propane is also a byproduct of the crude oil refining processes: propane from Gulf Coast crude oil refining operations can also be piped to and stored in the Mont Belvieu depot.

To make its way to New Hampshire, our propane molecule is then pumped across country in the Texas Eastern Transmission pipeline, known as TET, to distribution points in New York State. From there it is distributed to New England retailers in rail tanker cars or propane tanker trucks. Propane is then stored onsite at various propane retailers (see photo below) and from there it is transported by a smaller propane truck to be pumped into storage tanks at residences. Propane also makes its way into New England from East Coast petroleum refineries, natural gas operations in Pennsylvania, imports from Canada and, occasionally, waterborne imports from East and Gulf coast locations, or even Europe.

An illustrative diagram from the EIA, showing the flow of propane from well head to a home, is presented below.

There are two large propane storage terminals in New England. Both are located on the coast - one is in Providence, RI, and the other is in Newington, NH. Both are used to receive large shipments of waterborne propane but it is my understanding that these shipments are far and few in between at the moment as a result of low propane prices and the economics of waterborne propane shipments. In April this year, a plan to install a 22 million gallon propane storage facility in Searsport, Maine, was shelved due to local opposition and changing economic conditions in the propane business. The original intent of the project was to bolster propane storage for the State of Maine which was faced with a severe propane shortfall in the winter of 2007.

Let us now turn our attention to the matter of propane pricing. Presently propane is selling for $2.99/gallon for bulk residential delivery in NH but its price at the Mont Belvieu hub is $0.85/gallon. (Just last week, I filled my 5 gallon propane tank for my gas grill and it cost me $4/gallon.) I find these spreads between the commodity and retail prices very interesting, especially as we have to bear them. I want to understand how a product that costs less than $1/gallon in purified form at the main hub ends up costing us $4/gallon or higher. I find it useful to compare fossil fuel price spreads to those between crude oil and gasoline at the pump. Crude oil last week was about $106 per barrel (Brent pricing) and at 42 gallons per barrel, this calculates out to $2.53 per gallon of crude. Compare this to refined gasoline prices at the pump at $3.53 per gallon, which gives us a $1/gallon spread to cover refining, transportation, storage, taxes, marketing and a profit margin. Now I know this comparison of crude oil to refined gasoline at the pump is, at best, an approximation - as 1 gallon of crude does not necessarily lead to one gallon of gasoline but, for our purposes, it will suffice. The table below provides some spreads for hydrocarbon fuels and, even though these spreads are not exactly comparable, they provide a useful basis of comparison for the propane spread.

I have highlighted the propane ratio - which is on the low end at the moment. There are times, particularly in the high usage winter months, that this ratio will climb to 4.5 or as high as 5.

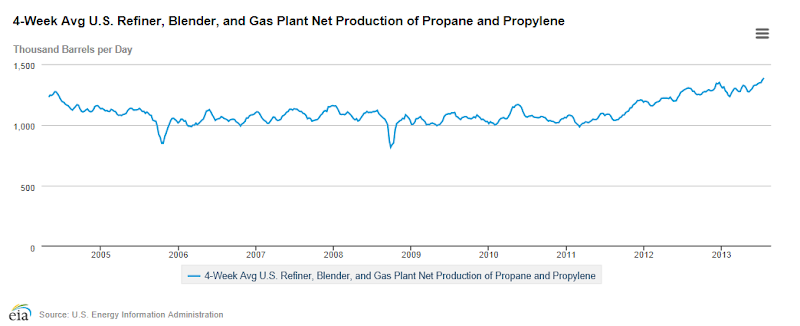

What are the reasons for these high spreads in propane prices? Why should propane cost more than 3.5 to 4.5 times its wholesale price at the hub - especially at a time when we are swimming in excess propane in the USA? In fact, we now have so much propane in the US as a result of the natural gas boom, that we are exporting large amounts of propane from the US.

It proved challenging to find someone in the NH propane industry to chat to me about these price issues. In every case, my calls to various propane dealers and even to the New England Propane Association went unanswered. I suppose one could generously assume that these folks were busy and simply did not have time to share with me the complexity of the propane business. Without an insider's understanding of the business, one is left with publically available information so here is what I know:

- The propane industry is an unregulated industry and, as such, does not come under the purvey of the Public Utilities Commission.

- There are a large number of propane distributors in New Hampshire, ranging from small operations to larger ones.

- The Consumer Protection and Antitrust Bureau of the NH Attorney General's office receives approximately 30 propane-related complaints per year.

- The propane business is highly seasonal, with sales peaking in the winter months -see the figure below.

- Propane dealers have to hold inventories of propane through the slow summer months and they have to bear the carrying costs associated with their propane inventories throughout the year.

- There are various different types of retail propane contracts out there. Some dealers will lease a storage tank to a customer. However, should a customer want to change suppliers, they have to pay significant costs to have the leased tank emptied and removed. These high changeover costs can essentially "lock in" a customer, making it difficult to change propane suppliers. A better solution would seem to be to own one's own tank but this requires a big upfront investment and some propane dealers only service their own tanks. It would seem that propane users would be beholden to a regional group of propane dealers and some propane users have complained of being held "captive" by their propane dealers.

- Generally, there is little transparency in the propane market as it is not a regulated commodity like natural gas or electricity. As such, residential propane users are subject to the whims and fluctuations in their regional distribution markets which may make getting competitive prices challenging.

- Propane prices fluctuate considerably from dealer to dealer and direct comparisons are sometimes difficult. Sometimes quoted prices are "all-in" delivery prices and sometimes they exclude delivery charges and other miscellaneous charges that get tacked on, such as hazardous material handling fees. According to the folks at the NH Office of Energy Planning, OEP, the spread of propane prices can sometime vary as much as a $1/gallon across the State.

As I worked to understand more about the propane industry, local pricing started to perplex me, especially when I compared it to national pricing averages. Consider the following facts:

- Due to the surfeit of propane, prices are down. In fact, propane prices used to be tightly coupled to those of crude oil. For many years, the commodity price of propane, the Mont Belvieu hub price, would run at between 60 and 70% of that of crude oil. Now the relationship has broken down and propane commodity prices are averaging about 40% of crude oil prices. This is reflected in lower propane commodity prices during the past two years as shown in the figure below. Since the peak in June 2008, propane prices are now 54% lower. In fact, commodity propane prices are close to what they were in 2004.

As can be seen, we in NH seem to have been subjected to a steady increase in the price of propane since 2004 and prices this past heating season were 226%(!) higher than those in 2004. It is interesting - and puzzling at the same time - to try to understand why long-term retail propane pricing has not reflected longer term changes in the underlying commodity prices. As I have noted earlier in this blog, the residential propane business is a very seasonal one and the challenge for propane dealers is that the bulk of retail propane sales are made in the winter months. However, they seem to be able to compensate for this by generally pushing prices higher during each heating season.

Even though I write from a NH perspective, the reader should appreciate that NH is not being singled out regarding residential propane prices: similar variations in residential propane prices have been observed throughout the US. But, here in NH propane consumers feel them more acutely as NH residential propane prices are, on average, 19% higher than the national average. That 19% average is perhaps reflective of the fact that we are pretty far down the propane distribution chain and it takes a lot to get that propane from Mont Belvieu, Texas, all the way to NH. It should be noted that I determined the 19% figure by averaging the retail prices for the individual heating seasons for the US and for NH and then calculated the ratio of the NH average heating season retail prices to those of the overall US numbers. In the figure below you can see the results of these calculations. The premium of NH propane prices to those of the US average fluctuates from year to year around the 1.19 average line but it is rather notable that the premium associated with NH retail propane this past 2012/2013 heating season is way above the average and NH propane cost 30% more than the US average. This clearly shows that NH propane consumers are not benefitting from lower commodity prices. While the US is now awash in propane and is exporting it, propane users in NH would seem to be subject to the whims of an unregulated propane market.

Regardless, the data clearly indicate that propane premiums in NH are presently excessive, compared to historical averages, and it will be interesting to see if they come back into line during the next heating season. For propane consumers in NH, it could be an expensive experiment.

Until next time, fill up your propane tank to the brim during the summer and remember to turn the lights off when you leave the room.

Mike Mooiman

Franklin Pierce University

mooimanm@franklinpierce.edu

8/16/13

(Crossing Muddy Waters* - A John Hiatt tune from a 2000 album with the same name. John Hiatt has always been one of my favorite singer songwriters and has been covered by dozens of artists including Bonnie Raitt, Bob Dylan, Keith Urban, Iggy Pop, etc. etc. He is worth discovering if you don't know his music. Enjoy Crossing Muddy Waters.)

Click on this link to receive email notifications for Energy in New Hampshire updates